AMM

An Automated Market Maker (AMM) is a decentralized exchange (DEX) mechanism that automatically provides liquidity in a protocol. AMMs rely on mathematical formulas to do what a limit order book does. AMM achieves that by using liquidity pools holding two or more token reserves. Although not as efficient as a limit orderbook, AMMs guarantee liquidity availability. Trading against an AMM involves executing orders against the reserves in these pools.

Liquidity providers in the AMM receive 25bps for all trades their position fills, paid by traders. The other 5bps is to be directed to the Insurance Fund.

nftperp AMM

A range-concentrated AMM concentrates the AMM between a lower bound α and an upper bound β. However, Prices are volatile. An asset trading at 1 ETH today can reach 100 ETH someday and vice versa. Thus, finding an α and β that adapts to the price volatility without losing the power of concentrated math is impossible.

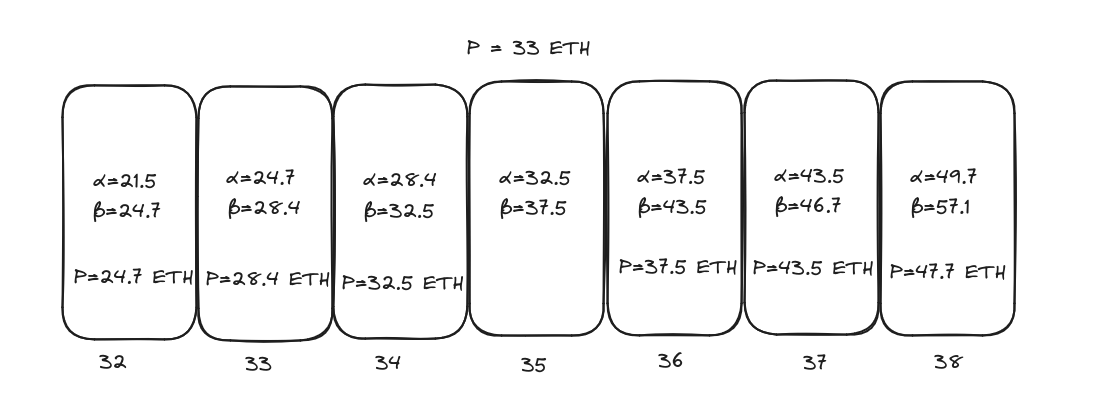

To solve this problem and provide better options to the Liquidity Providers, we have created a concept called AMM Pools. Each pair has multiple AMMs called a pool. For a pool n belonging to an NFT, its lower bound equals the upper bound of the previous pool, and its upper bound is R percentage larger than its lower bound. For most pairs, R is instantiated between 3-6% -- a range very popular among Uniswap V3 LPs.

Pool Example

In the figure above, α denotes a pool's lower bound, β denotes its upper bound, and P is the initial mark price of the NFT, currently set to 33 ETH. As 33 lies between 32.5 and 37.5, its active pool is Pool 35.

Trading in the Pool

If there is 15 ETH of liquidity in each pool and someone creates a long position of 20 ETH, 14.5 ETH will be matched against pool 35, taking the price to 37.5 ETH. Then, the remaining 5.5 ETH will match against pool 36, taking the price to 40 ETH and making pool 36 the active pool. The active pool can move further than pool 36 if the trade is large enough. This works similarly for a short in the reverse direction.

Last updated